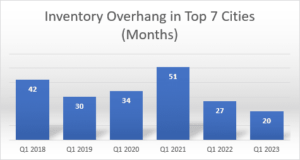

Q1 2023-end Housing Inventory Down to 20 Months from 42 Months in 2018

- The lowest inventory overhang in last five years; in Q4 2020, it was the highest at 55 months across the top 7 cities

- In Delhi-NCR, inventory dropped the most in last five years – from 66 months in Q1 2018 to just 23 months in Q1 2023

- At just 13 months, Bengaluru’s current inventory levels are the lowest among the top 7 cities, followed by Pune, Chennai and Kolkata at 20 months each

- Inventory overhang in MMR reduced to 21 months from 55 months in Q1 2018

- Top 7 cities’ cumulative unsold stock declined by 12% in last 5 years – from 7,13,400 units by Q1 2018-end to approx. 6,26,750 units by Q1 2023-end

On the back of significant momentum in the residential property market, housing inventory overhang across the top 7 cities plunged to just 20 months by Q1 2023-end, from 42 months by Q1 2018-end – reaching the lowest in the last five years. ANAROCK data shows that the inventory overhang in the top 7 cities in the last five years was the highest by Q1 2020-end, at 55 months.

Inventory measured in months indicates the number of months it will take for the current unsold housing stock on the market to sell at the current absorption rate. An inventory overhang of 18-24 months is normally considered healthy at any given period.

Anuj Puri, Chairman – ANAROCK Group, says, “Among the top 7 cities, NCR remained the frontrunner in reducing overall inventory overhang in the last five years – from 66 months in Q1 2018 to approx. 23 months in Q1 2023. This is the best the region has seen in the last five years. In fact, inventory overhang in NCR had peaked at 88 months in Q4 2020.”

Source: ANAROCK Research

“In Q1 2023, the top 7 cities recorded all-time high sales of more than 1.14 lakh units,” says Puri. “The quarter broke all records and breached the 1 lakh units mark for the first time. Strong homeownership sentiment, relatively lower home loan rates, strong momentum in luxury housing and the anticipation of further price hikes were major factors in boosting housing sales, bringing down the overall residential inventory overhang across the top cities.”

The cumulative unsold stock in the top 7 cities saw a 12% decline in the last 5 years – from 7,13,400 units by Q1 2018-end to approx. 6,26,750 units by Q1 2023-end.

Top Hotspots – MMR & NCR

- Among the top 7 cities, NCR saw the maximum 5-year inventory reduction – by 43 months (from 66 months by Q1 2018-end to approx. 23 months by Q1 2023-end). This region was the third-best housing sales performer in Q1 2023.

- In MMR, the inventory overhang has shrunk by 34 months in this period, attaining an all-time low of 21 months in Q1 2023. MMR recorded the highest sales among the top cities, with approx. 34,690 units sold in the quarter – an increase of 182% against same period in 2018.

Other Cities

- Bengaluru currently has the lowest inventory overhang (of 13 months) among the top cities. It is one of the most resilient residential markets in the country. In Q1 2021 during the pandemic, Bengaluru’s inventory overhang stood at 28 months – the lowest among all cities then, as well.

- Hyderabad’s inventory overhang reduced to 21 months in Q1 2023, from 23 months in Q1 2018. Despite Hyderabad adding the second-highest new supply in the last one year, the current inventory overhang reflects healthy sales in this period.

- Pune’s inventory overhang stood at 20 months as of Q1 2023-end. It was 40 months in same period of 2018 and reached 43 months in Q1 2021.

- Chennai too saw a considerable drop in its inventory overhang – from 36 months in Q1 2018 to 20 months in Q1 2023.

- Kolkata’s residential inventory overhang has dropped from 46 months in Q1 2018 to 20 months as on Q1 2023-end.

“This content is provided by the company and the website will not be responsible in any way for the content of this article.”