Housing under Modi – A 10-year retrospective – NAREDCO-ANAROCK report

- With reforms, housing demand soars – over 28.27 lakh homes sold in top 7 cities between 2014 to 2023; over 29.32 lakh units launched in the last 10 years

- AIFs revive hope – from 2019 inception to December 2023, approximately 26,000 homes completed by SWAMIH Fund, 80,000 more to be completed in the next 3 years

- RERA – approximately 1.23 lakh projects registered across states since inception till date, 1.21 lakh complaints disposed

- PMAY delivers affordable housing to urban & rural poor – approximately 118.63 lakh homes sanctioned under PMAY(U) till date, 294.86 lakh homes under PMAY(Gramin)

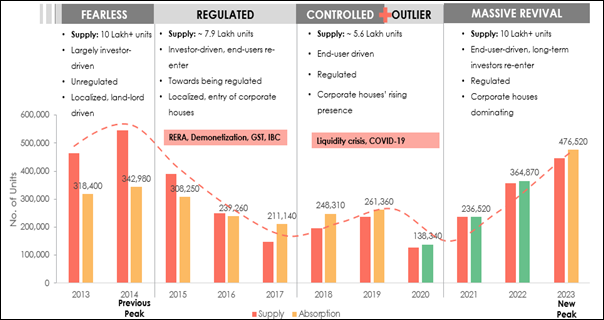

- Demonetization in late 2016 cleaned up real estate – fly-by-night developers exited the market, major consolidation under stringent regulatory overhauls

- Consistent Government push boosts new alternate asset classes – warehousing, data centres, co-living, senior living & student housing

The Indian residential real estate market has greatly benefited from several reforms by the Modi-led government, helping the industry to not only to emerge stronger but also to scale new heights. A new report ‘Real Estate Unboxed: The Modi Effect’ by ANAROCK and NAREDCO showcases a housing landscape that is ripe with potential for evolving growth opportunities.

Anuj Puri, Chairman – ANAROCK Group, says, “The report tracks how India’s residential real estate sector has thrived in the past decade. The findings are convincing – housing demand and new supply in the top 7 cities have soared in the last 10 years, particularly post the pandemic, and housing sales are now aligned with new launches. The report finds that approximately 28.27 lakh units were sold in the top 7 cities between 2014 and 2023, while cumulative new launches stood at over 29.32 lakh units. Residential property prices have also registered significant demand-led growth across the top 7 cities. Over the last decade, average housing prices have appreciated in the range of 25-60% across these cities.”

Niranjan Hiranandani, Chairman – NAREDCO, says, “In light of the Indian government’s reforms over the last decade, NAREDCO and ANAROCK collaborated to assess the Indian real estate sector’s growth. Over the last decade, India’s economy has impressively leapfrogged to the 5th position on the global economic performance ladder. The Indian economy has maintained its status as the fastest-growing major economy for three consecutive years, a beacon of hope in a contractionary global economic climate. A market size of US$ 1 trillion is expected by 2030, up from US$ 200 billion in 2021. This market size is expected to contribute 13% to India’s GDP by 2025, making the sector a pivotal contributor to economic development, employment, and government finances.”

The report finds that housing inventory overhang has seen a significant drop over the last 10 years. The pan-India housing inventory overhang stood at 15 months at the end of 2023 – displaying a positive decline from 41 months in 2017, when available inventory was at its peak. Given that 2020 was the Covid-19 year, it is more of an outlier. This is significant, considering the massive new supply added during this period.

Source: ANAROCK Research

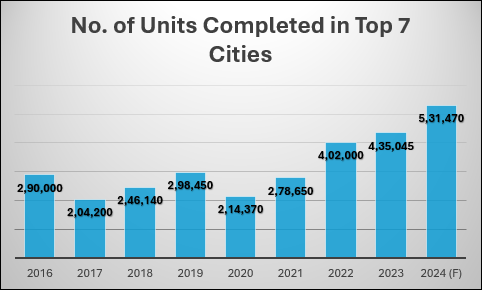

The report further highlights that completion of units in the top 7 cities has seen significant growth over the years, particularly post pandemic. Data indicates that at least 44% more units were completed in 2022 as compared to 2021. This is interesting because during the pandemic all construction activities were completely halted for a period. As of 2023, we saw completion of nearly 4.35 lakh units in the top 7 cities while in 2024 it is estimated that more than 5.31 lakh units are expected to be completed.

Source: ANAROCK Research

A Decade of Change

The report tracks a decade of significant change in the Indian real estate sector, led by various game-changing reforms and policies like RERA and the SWAMIH alternate investment fund, which reignited confidence and hope in the sector. Implemented across many states since 2017, RERA finally brought regulation to the real estate sector, safeguarding the interests of homebuyers by ensuring transparency, timely project completion, and accountability among developers.

According to the latest government data, approximately 1.23 lakh real estate projects have been registered across states since RERA's inception till date, and more than 1.21 lakh consumer grievances have been addressed across the country.

Since its inception in 2019 till December 2023, the SWAMIH Fund has completed approximately 26,000 homes in the country, and 80,000 more are projected to be completed over the next three years.

The government backed SWAMIH (Special Window for Affordable and Mid-Income Housing) Fund aims to provide financial support to stalled affordable and mid-income housing projects that were struggling due to capital shortfalls. It has played a crucial role in addressing the sector's liquidity issues, especially amid challenging economic conditions. It has also boosted the growth of many ancillary industries in the real estate and infrastructure sectors, having successfully unlocked liquidity of more than INR 35,000 crore.

The report also highlights the positive impact of various other government-backed initiatives such as PMAY (Urban & Gramin), GST, demonetization, and the growing adoption of technology in real estate over the last decade.

PropTech (Property Technology) has ushered in innovative solutions such as blockchain for secure and transparent transactions, AI-driven analytics for property valuation, and enhanced smart home technologies. These advancements streamline processes, improve efficiency, and reduce the time required for transactions. Currently, PropTech Startups account for 6% of India's total recognized startup universe.

By 2030, the Indian residential real estate sector's market size is estimated to reach USD 1 trillion, with an expected contribution of 13% to the nation's GDP by 2025.

In the years to come, the real estate industry will proactively restructure its strategies to align with economic conditions. This strategic shift towards balance will highlight the industry's ability to withstand challenges and adapt flexibly. The sector's growth prospects will be strengthened by factors such as a stable government, consistent interest rates, job creation, and increased private sector investment.

Click to download the report Real Estate Unboxed – The Modi Effect 2023-24